Just Ask

Your AI Coach

Your AI Coach

Meet your new greatest ally in achieving financial health.

92%

92%

of employees are stressed about finances1

57%

57%

would struggle to fund a $1,000 unexpected expense2

48%

48%

of employees have more debt than is manageable1

Tired of blanket statements and generic advice?

We are, too.

Because the Financial Wellness Coach isn’t a chatbot that summarizes search engine results, you can trust in the responses you get.

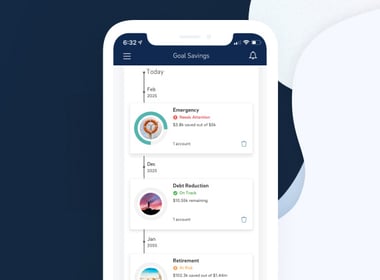

From learning how to move beyond living paycheck-to-paycheck and stabilize your cashflow to understanding how to maximize your benefits, your Coach provides accurate, personalized information tailored to your specific needs and unique situation.

Get real-time answers to your money questions when you need them, 24/7.

Maximize your benefits in three steps with your Financial Wellness Coach.

Your finances are personal.

For us, that means your data is private and secure. Period.

At BrightPlan, we go above and beyond government requirements for data security and protection. We prioritize privacy and security. All personal data is encrypted and stored securely. We adhere to strict data protection regulations and use advanced security measures to prevent unauthorized access.

For the Financial Wellness Coach, we rely on Anthropic's privacy/security policies and constitutional principles. This means that they do not retain prompts that we pass to them for more than 30 days and they do not use those prompts for their training purposes. We maintain all of the same rigor and standards as are outlined in our privacy policy.

Top 5 FAQs: BrightPlan Financial Wellness Coach

What is BrightPlan's Financial Wellness Coach?

What is BrightPlan's Financial Wellness Coach?

Finances can be confusing. Strong guidance can unlock incredible opportunities, but bad advice can have serious financial consequences. The patented BrightPlan Financial Wellness Coach provides real-time 24/7 personalized guidance that is fiduciary in nature (meaning acts in your best interest and nobody else's).

How do I get the best answers from the Coach?

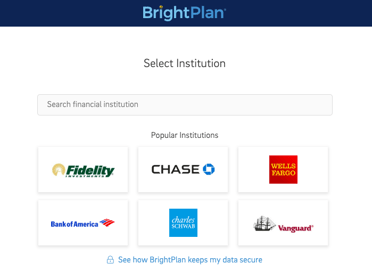

The more you share, the more beneficial the Coach’s responses will be for you. In BrightPlan, complete your profile, link your financial accounts (banks, credit cards, investments, loans, etc) and set the financial goals you want to achieve. By providing this information, your coach will personalize its responses for your financial situation with its guidance.

Is my personal data secure in BrightPlan and with the Coach?

Absolutely. We prioritize privacy and security. All personal data is encrypted and stored securely. We adhere to strict data protection regulations and use advanced security measures to prevent unauthorized access.

Your financial information is personal. Your employer will not have access to it. Your data is used solely to provide personalized financial advice and improve your financial well-being. The Coach has read-only access to your accounts, and only for the purposes of responding. It will never share, sell, send, or otherwise release anything about your financial goals or situation.

How do I know it will give accurate and reliable answers?

This is a common question everyone has when seeking financial guidance whether it is from a financial advisor, 401(k) provider, friend, family member, colleague, social media platform or a search engine like Google.

The differentiator for BrightPlan’s Coach is its fiduciary nature, meaning it acts in your best interest and nobody else's. This means that BrightPlan isn’t providing guidance to sell you other products, investments, or anything else. The Coach is only focused on supporting your financial success.

If you don’t like any of the answers the Coach provides, you can help train it to your preferences by giving it a thumbs up for great advice or thumbs down for missing your mark. It will incorporate your feedback in future responses to make it as helpful as possible for you.

What countries is the Coach available in?

Initially the Coach will only be available in the U.S. We will continue to expand this functionally globally as we currently support over 34 countries around the world with BrightPlan!

Disclosure:

1. BrightPlan 2023 Wellness Barometer Survey

2. 2023 Bankrate Emergency Savings Report.

3. Based on BrightPlan customer retention data against the national average for retention.

4. Savings rate is defined as national median retirement savings and national median emergency savings savings divided by the national median annual income.

5. Net Promoter Score (NPS) is based on post-advisor call client surveys as of December 2022.